OVERVIEW

National surveys paint a troubling picture of the current state of financial capability in the U.S. Most surveys concluded that college students demonstrated especially poor financial capabilities. In a recent financial survey conducted by Higher One, Inc. 70% of students surveyed received a failing score with more scores in the bottom levels than in any previous year. Against the backdrop of a fluctuating economy, and high tuition and student loan rates, the consequences of not having the necessary tools and skills to make sound financial decisions are even more severe.

This project focuses on the development and design of two fundamental pieces of an iPhone money management/banking application made specifically for college students. The goal of this app is to help students evaluate their spending habits in a novel way, initiate financial plans and set goals. Although we did not design the whole money management app, the two areas of focus were to create the basis for financial capability for a user and a particular thorny challenge for creative team.

PERSONA

Daniel (college student).

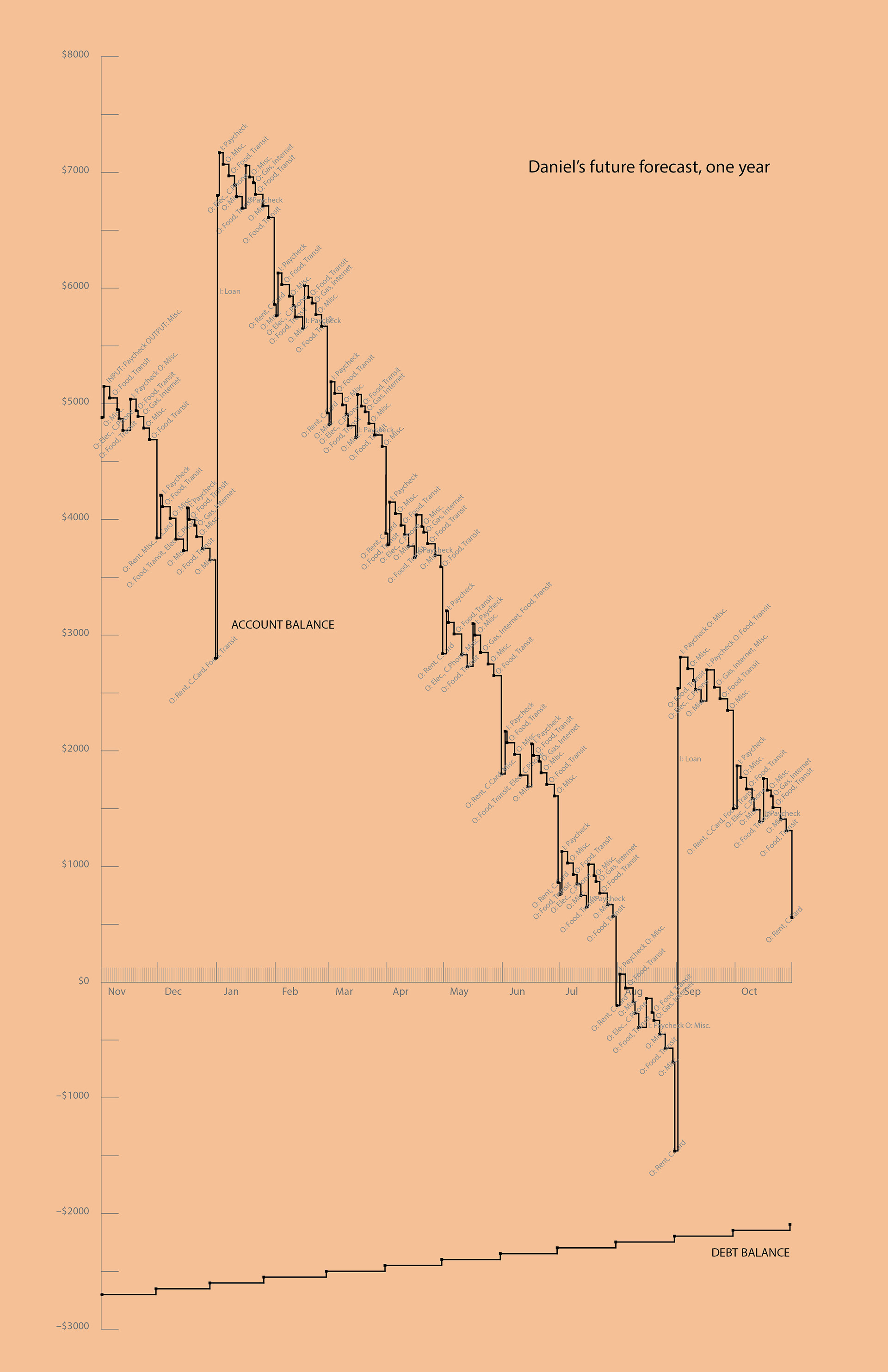

Our first task is to use the data from Daniel's previous year and his current budgets to visualize a probable financial situation for Daniel in the upcoming year. We have done this by producing an input/output forecast histogram for one full year starting November 1st, 2018 and ending October 31st, 2019.

the overall strategy

1: The app catalogs past spending and earnings. Using this data, the app forecasts (predicts) future spending and earnings and thereby assesses the user's financial outlook. The app will explain the financial future to the user, help the user dodge financial trouble ahead and set up saving goals. With a catalog of the user's past data and an assessment of their financial future and saving goals, the app can establish a responsible budget for the user and encourage the user to stay within their budget.

2: The app breaks down spending into BASIC, non-discretionary, or non-optional, usually fixed spending (rent, utilities, tuition) and discretionary, or BOUGIE, optional and variable, spending (food, entertainment, school supplies...). The app needs to catalog and forecast all spending to accurately track and predict balances. However, the app focuses its user on management of discretionary spending and discretionary spending habits.

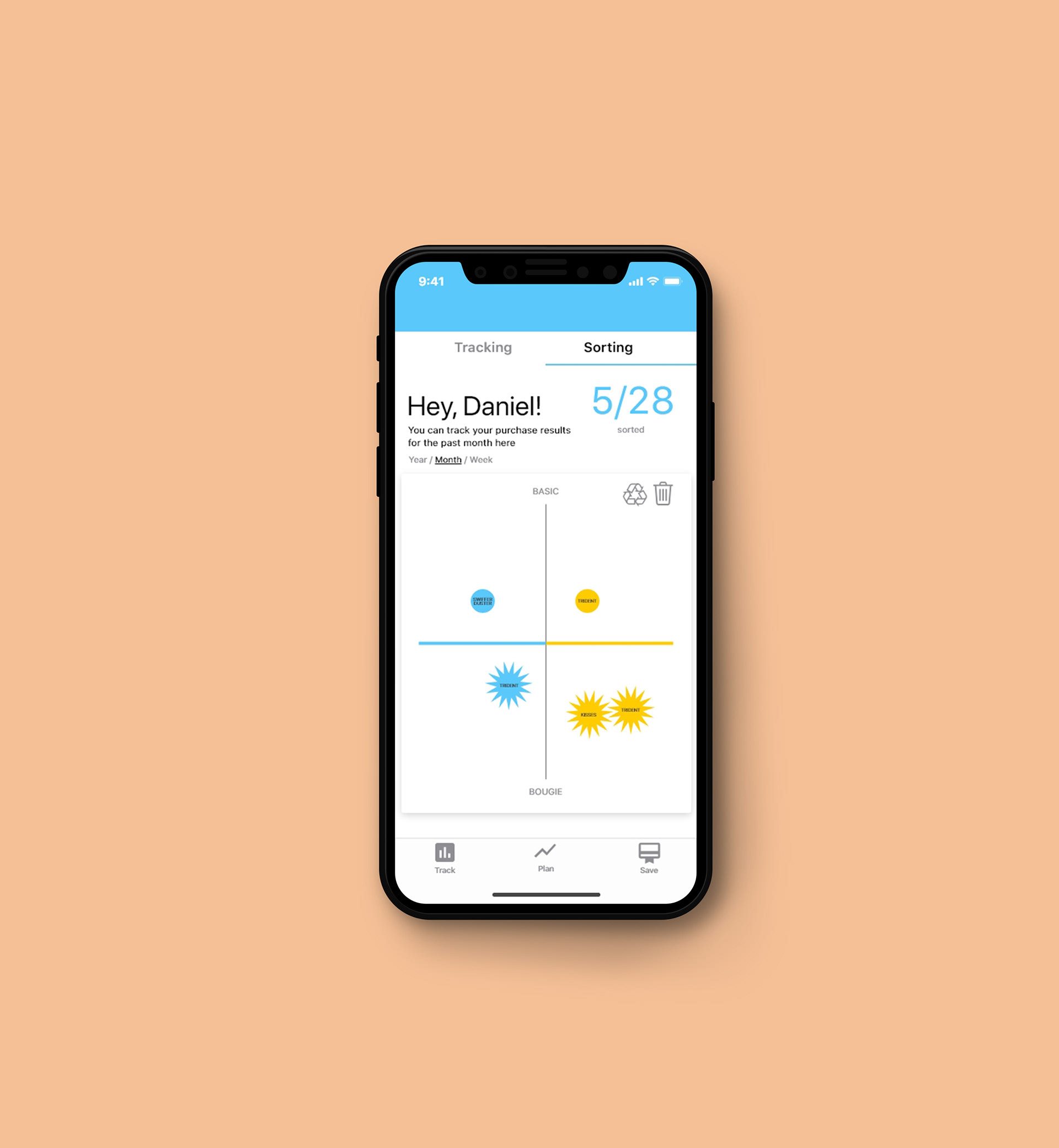

3: To analyze spending in a new and novel way, the app asks the user to rank each instance of their discretionary spending on a scale from Basic (necessary) to Bougie (unnecessary) and to mark the level of happiness from each purchase. This will give the user the ability to decide for themselves how critical each moment of spending is. The app in return will compile the data, display the data, and help analyze spending habits and patterns to aid savings goals, tweak budgets, and address forecasted crises.

Ranking purchases

How does the app get the initial information about the purchase and in what level of detail?

The app gets all information directly from user's credit card or he/she can scan the receipt and purchase will appear in the app.

How does a user input and rank a purchase?

The rank system is designed as clear bubbles of purchases that user moves on the screen and drops in the corner that represents Basic&Happy / Bougie&Happy / Basic&Unsatisfied / Bougie&Unsatisfied. Bubbles will modify after categorization. (Words "Basic" and "Bougie" are choosen so the app is using same language that college students).

When does the app ask for this rank?

The app is designed for students, so the best way is to ask user to categorize purchases is to send notifications during the time when Google Maps (or other navigation services) is on bus mode. Either wat the app will send notifications at noon or 8pm.

Track.

Chech the past spendings and track the future to stay on right route with your spendings.

HOME PAGE

The Home page is a long-scroll page that includes all information the user needs to know immediately and has quick access to all features. The data of daily budget, unsorted transactions, goals, slush fund, recommendations and forecast are here, just scroll:)

Recommendations

Compiling and displaying data will give Daniel an overview, but the app will go one step further and help Daniel analyze the patterns, compare and summarize his data, and make recommendations. This is where the app really becomes powerful in revealing and changing spending habits.

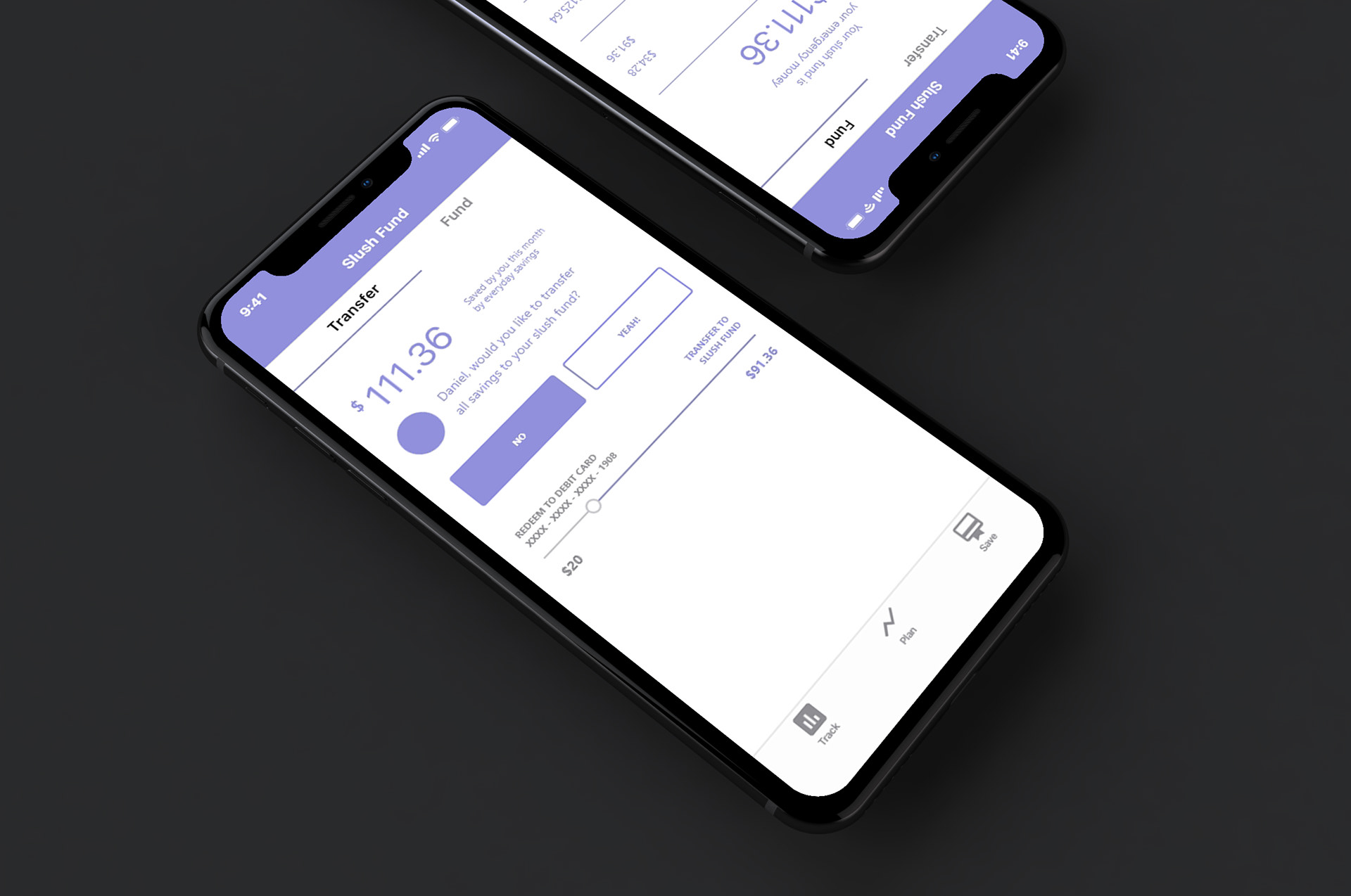

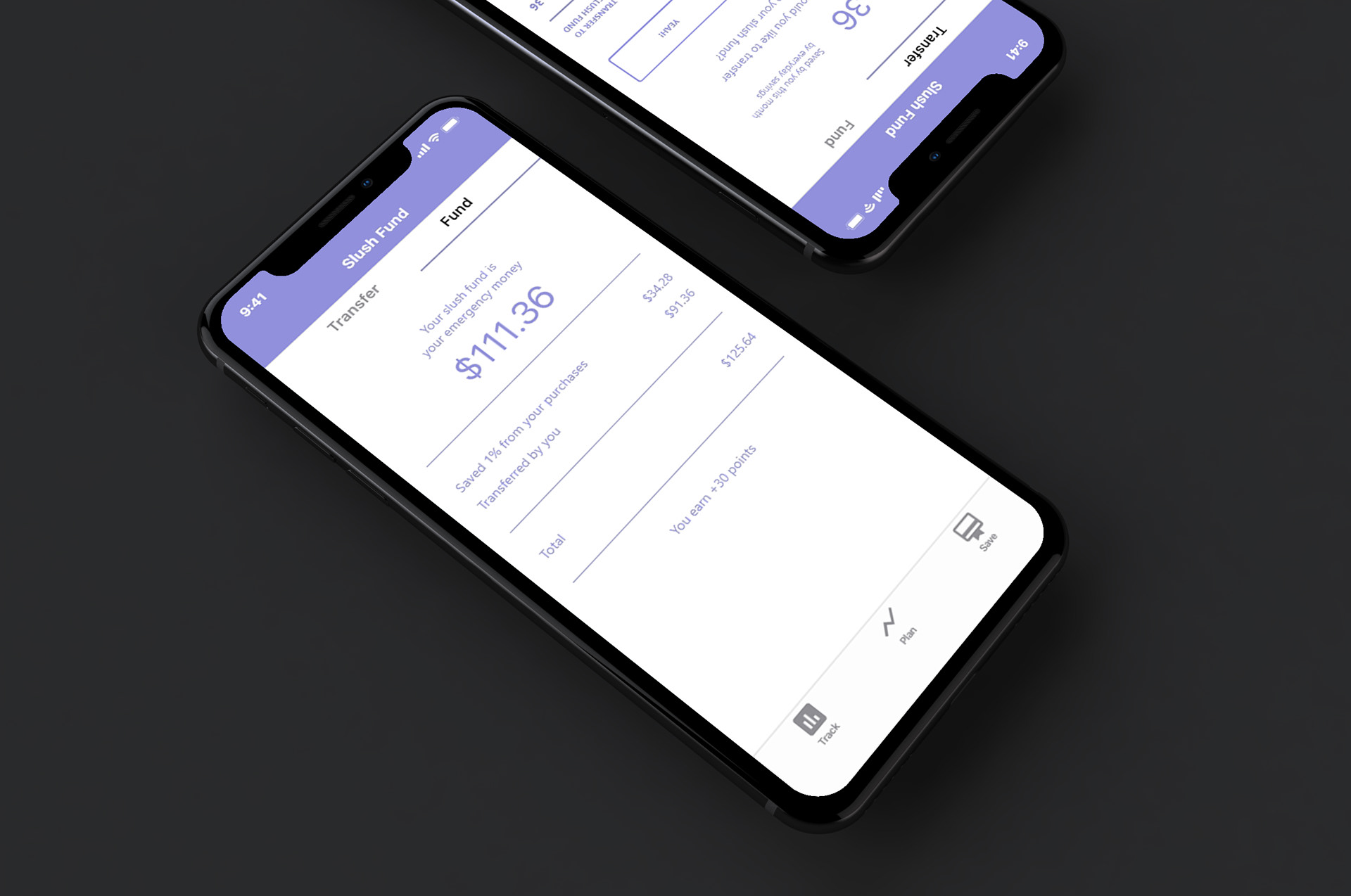

SLUSH FUND

Slush fund―your smart way to save money. By automatically saving 1% from your daily purchases and transferring small amounts from daily savings, you can collect money for your future needs and wants. Additionally, you can transfer into this safe zone money that were saved from your daily budget at the end of the day/week.

Plan.

Add your big purchases into Calendar, so the app will modify your daily budget and will help you to stay far away from overdraft in the future.

Earn.

Collect rewards to motivate yourself! Earn points for healthy budget habits, save even more, redeem point for favorite things and collect motivational badges in Achievments section.

P.S.: The app is a huge team-based project. I'm posting only parts of it that were under my resposibilities. Thanks for understandind and apreciating my project!

THANK YOU!